Illinoisan will have the ability to vote for a fair tax system, which offers them the opportunity to discard an outdated and inflexible tax system and replace it with one that corresponds with their income.

“We are one of the few states in the country to still have a flat tax. We’re losing residents every year and they’re going to neighboring states that have a fair tax system,” Belt said. “If we want to keep our residents in Illinois, we must adopt a fair tax or they are going to move to Minnesota, which is a leader in job creation because they have fair tax. It’s time for the wealthy in Illinois start paying their fair share and taxes be cut for working families’.”

Illinois is one of only nine states that currently have a flat income tax. Midwestern states with a fair tax system include Missouri, Wisconsin, Iowa, Kentucky, Kansas, Nebraska, Ohio and Minnesota.

Also on Wednesday, Belt voted for measures that would eliminate the estate tax and offer tax relief to property owners that are tied to full state funding for school districts. The measures are part of the fair tax package pending in the legislature.

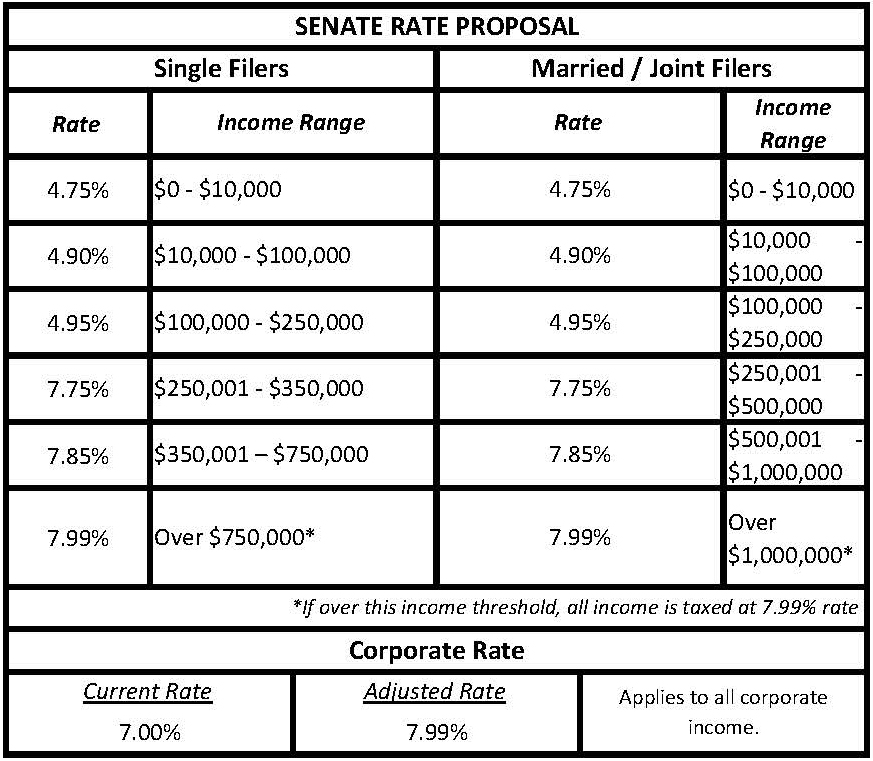

Income tax rates proposed by Senate table: